2025 Poland Global Money Week

GMW NATIONAL COORDINATOR:

- The Polish Financial Supervision Authority (UKNF)

PARTICIPATING ORGANISATIONS:

-

Bank Guarantee Fund, Ministry of Finance, National Bank of Poland, Polish Financial Supervision Authority, Office of Competition and Consumer Protection, Credit Information Bureau (BIK), Polish Chamber of Pension Funds and CFA Society Poland, Czepczyński Family Foundation, PFR Foundation, Society for Promotion of Financial Education, Warsaw Institute of Banking Foundation, 520 education facilities (mostly schools at all stages of education but also special school and education centres, libraries)

TOTAL NUMBER OF PARTICIPATING ORGANISATIONS:

- 532

NUMBER OF PEOPLE REACHED INDIRECTLY:

- 54 557

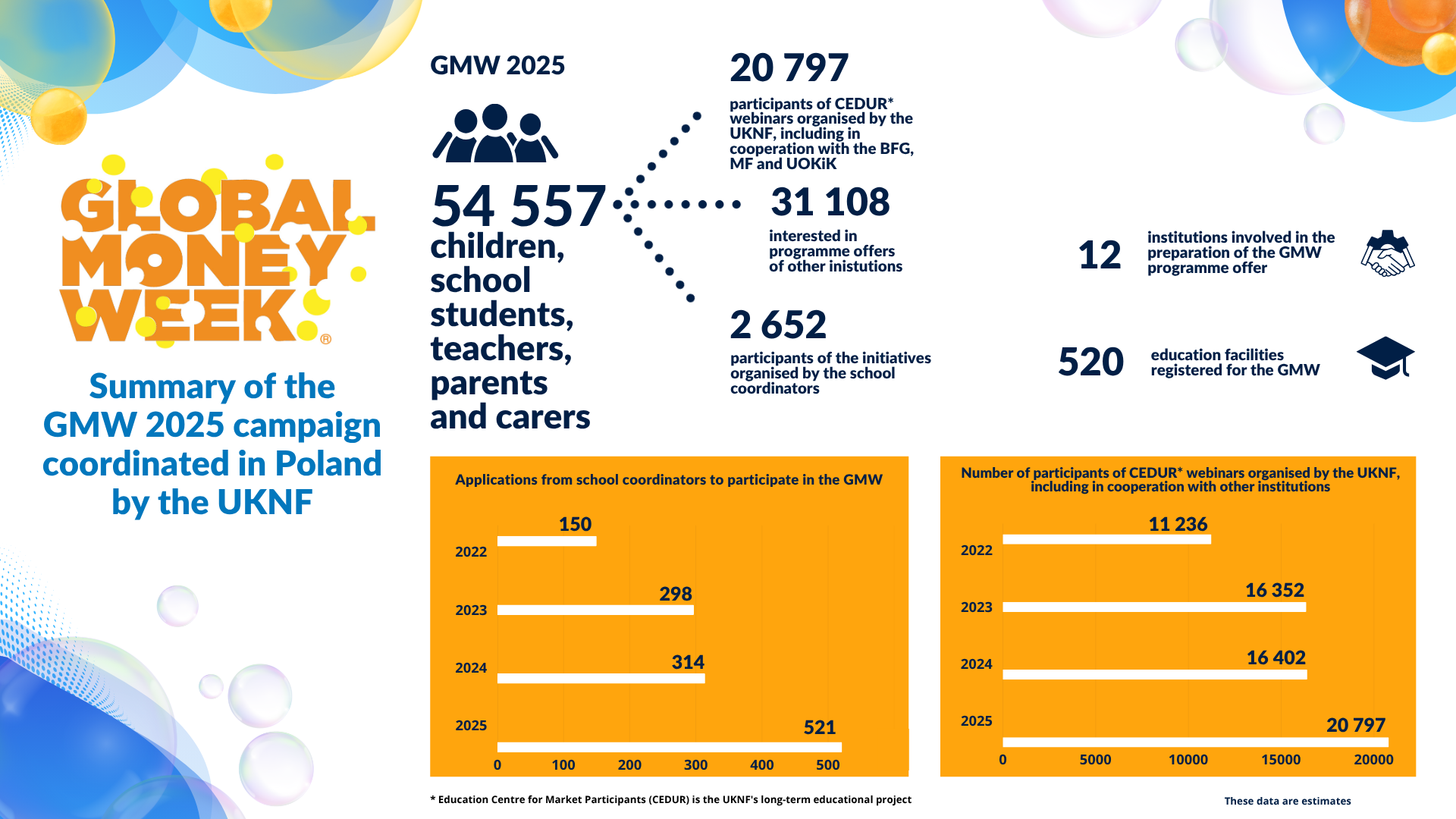

The 13th edition of Poland’s Global Money Week took place on from 17 to 23 March under the theme ‘Think before you follow, wise money tomorrow.’ Poland’s GMW reached over 54 000 participants, mostly children, school students, teachers, parents, grandparents and carers, who took part in the national edition of the GMW coordinated by the UKNF (Polish Financial Supervision Authority).

Schools at all stages of education including special schools, education centres, and libraries participated in the campaign. The UKNF and 11 other institutions prepared educational tools and resources. School coordinators launched their own initiatives by organising cross-class interactions, such as peer-to-peer activities and cross-generational activities like cybersecurity trainings for seniors run by students.

As part of GMW 2025, the UKNF delivered webinars to students and teachers, including webinars held in co-operation with other institutions. The webinars were organised as part of the Education Centre for Market Participants (CEDUR) project. They covered a wide range of financial topics, such as cybersecurity, how not to get scammed on the internet, investing, taxes, how to avoid debt spiral, and understanding young driver insurance.

Participants of GMW were able to explore the campaign’s programme on a dedicated website featuring information on educational initiatives, projects, programmes, tools and resources.

2024 Poland Global Money Week

GMW NATIONAL COORDINATOR:

- The Polish Financial Supervision Authority (UKNF)

PARTICIPATING ORGANISATIONS:

-

Bank Guarantee Fund, National Bank of Poland, Ministry of Finance, Financial Ombudsman, Office of Competition and Consumer Protection, Polish Chamber of Pension Funds and CFA Society Poland, Polish Chamber of Insurance, Faculty of Organisation and Management of the University of Warsaw, Czepczyński Family Foundation, Financial Market Development Foundation, Society for Promotion of Financial Education, Warsaw Institute of Banking Foundation and GPW Foundation

TOTAL NUMBER OF PARTICIPATING ORGANISATIONS:

- 14

NUMBER OF CHILDREN AND YOUNG PEOPLE REACHED DIRECTLY:

- 74 308

NUMBER OF ADULTS REACHED DIRECTLY:

- Not reported

NUMBER OF PEOPLE REACHED INDIRECTLY:

- Not reported

More than 74 000 participants, mostly children, school students, as well as teachers, parents and caretakers, registered for the national edition of the GMW in Poland, coordinated by the UKNF.

The GMW involved various activities undertaken in the area of financial education in schools at all stages of education and in other facilities, i.e. special school and education centres, and libraries participating in the campaign. The school coordinators also launched their own initiatives and used the GMW2024 programme offers prepared by the UKNF and other institutions.

The programme offers for the 12th GMW were prepared by 13 institutions: Bank Guarantee Fund, Ministry of Finance, Financial Ombudsman, Office of Competition and Consumer Protection, Polish Chamber of Pension Funds, CFA Society Poland, Polish Chamber of Insurance, Faculty of Organisation and Management of the University of Warsaw, Czepczyński Family Foundation, Financial Market Development Foundation, Society for Promotion of Financial Education, Warsaw Institute of Banking Foundation, and GPW Foundation.

The participants of the GMW could explore the Campaign’s programme at a website prepared by the UKNF, with information on educational initiatives, projects, programmes, tools and materials.

As part of the GMW 2024 programme offer, the UKNF delivered 14 webinars for students and teachers, as well as parents and caretakers, including two webinars in cooperation with the BFG and one with UOKiK. The webinars were organised as part of the Education Centre for Market Participants (CEDUR) project. The webinars focused on financial matters, such as cybersecurity, how not to get scammed by cybercriminals, what you should know as a young investor, how to make rational financial decisions, how to avoid debt spiral, how to secure pension protection. More than 16 000 participants registered for the webinars organised by the UKNF. More than 39 500 participants expressed interest in the programme offers, including educational tools and materials, prepared by institutions cooperating with the UKNF.

The Ministry of Finance prepared educational tools which could be used by teachers and educators during the GMW, including participation in the 9th edition of an educational programme addressed to students and teachers of grades 5 to 8 of primary schools: ‘Be financially active: we pay taxes, we see benefits” [‘Finansoaktywni: Podatki płacimy, korzyści widzimy’]; an online educational platform on taxes: TAXEDU; and Virtual tour of the Ministry of Finance.

The Bank Guarantee Fund prepared two presentations as part of CEDUR webinars: ‘How the funds of financial institution customers are protected’ and ‘Debt spiral: how to avoid it’.

On 20 March, the Financial Ombudsman invited five secondary school students from Warsaw to an all-day traineeship during the Entrepreneurship Day organised together with the Young Entrepreneurs Foundation. On 21–22 March, during the Financial Ombudsman Day, workshops and a conference on the current trends and challenges in the use of financial services were held at the Faculty of Law and Administration of the University of Gdańsk. The Financial Ombudsman also conducted two finance classes for primary school students. In addition to educational meetings, the Financial Ombudsman offered lesson scenarios relating to consumer protection in the financial market.

The Office of Competition and Consumer Protection (UOKiK) held a webinar: ‘A lesson of assertiveness for consumers: JUST SAY NO!’, on how to use the internet in a safe way. The UOKiK also offered an educational tool for teachers and students of secondary schools and higher grades of primary schools: konsument.edu.pl. The tool is a simulator of a social networking site which initiates 10 incidents/threats actually occurring online, e.g. online purchase scam, BLIK code phishing, subscriber scam, alternative investments, pyramid schemes. The teachers and educators could also benefit from the educational materials as part of the project ‘Be up to date with the law’, prepared by the Lex Cultura Foundation, addressed to young consumers and dedicated to the security of money used online.

As part of the GMW 2024, the Polish Chamber of Pension Funds (IGTE) and CFA Society Poland provided free access to students of secondary schools to an e-learning course ‘Well-groomed finances’, dedicated to personal finance, as well as an online publication titled ‘Manual on pensions’ [Przewodnik emerytalny] which serves as a compendium on how to prepare for life after retirement. Moreover, the IGTE invited adult students of secondary schools to watch conversations with experts in the form of video podcasts on non-financial and financial transition to retirement as part of the ‘Well-groomed future’ [Zadbana przyszłość].

The Polish Chamber of Insurance (PIU) invited the participants to watch a cycle of videos on insurance. It also provided various materials on the PIU website such as comic books, podcasts and lesson scenarios for teachers as part the subject Business and Management.

The Faculty of Management at the University of Warsaw organised a webinar ‘Stock exchange: discovering the world of capital markets’ addressed to young people and students of secondary schools and universities.

The Czepczyńki Family Foundation (CFF) organised a webinar for parents and teachers titled ‘Financial Basics for the Youngest: How to spark interest in finances and saving among children’ and an international online debate: ‘Financial education of children in Europe – best practices and challenges’.

The Financial Market Development Foundation (FRRF) organised a webinar ‘Consumers and their rights in the financial services market’, addressed to teachers and students of secondary schools. The FRRF’s webinar was an opportunity to pass the knowledge on, for example, the rights of financial service customers, the principles of drafting and submitting complaints, the alternative methods of resolving disputes with financial institutions, and specialised entities protecting consumers’ rights.

The Society for Promotion of Financial Education (SKEF) provided the participants, on a page dedicated to GMW 2024, with access to educational materials, including lesson scenarios for students of primary and secondary schools. SKEF organised a quiz on cybersecurity and a quiz on personal finance management. The teachers running the 16th edition of the project ‘Be smart with your finances! How to manage your finances in personal life' [Żyj finansowo! Czyli jak zarządzać finansami w życiu osobistym’] conducted workshops for students at 19 secondary schools.

The Warsaw Institute of Banking and the GPW Foundation organised the 8th Congress of Financial Education and Entrepreneurship. The activities accompanying the Congress involved, for example, a cycle of nationwide online classes and an educational meeting for older people.

During the GMW, the National Bank of Poland (NBP) reached thousands of people by organising a number of interesting educational events for various age groups, and by creating a specific subpage at nbp.pl/edukacja. Numerous people who visited the subpage could choose from brochures on personal finance, i.e. YOUR PLAN for secure finances, lesson scripts, simple animations introducing difficult economic concepts and webinars. The staff of the NBP conducted classes, lectures and online meetings and invited students to regional branches of the NBP located in all voivodship cities in Poland, where children could join competitions and quizzes. The educational events reached nearly 3,000 people – from the youngest preschoolers and students from primary and secondary schools to university students, parents and senior citizens.

The participation in all the initiatives and the use of the educational materials and tools provided under the GMW 2024 was free of charge.

2023 Poland Global Money Week

GMW NATIONAL COORDINATOR:

- The Polish Financial Supervision Authority (UKNF)

PARTICIPATING ORGANISATIONS:

-

Ministry of Finance (MF), the Bank Guarantee Fund (BFG), the Office of Competition and Consumer Protection (UOKiK), the Financial Ombudsman (RF), the Polish Chamber of Insurance (PIU), the Warsaw Institute of Banking (WIB) and the WSE Foundation, the Centre for the Development of Education (SKEF), Polish Chamber of Pension Funds (IGTE) and CFA Society, schools at all stages of education, other educational facilities, libraries

TOTAL NUMBER OF PARTICIPATING ORGANISATIONS:

- 294

NUMBER OF CHILDREN AND YOUNG PEOPLE REACHED DIRECTLY:

- 53 883

Over 53.000 students and teachers registered for the 11th edition of the GMW. The GMW2023 campaign in Poland, coordinated by the UKNF, included financial education activities implemented locally by school coordinators, at schools at all levels of education and at other educational facilities and libraries. The school coordinators took their own initiatives but also used the programme offer prepared by the UKNF and other institutions, i.e. the Bank Guarantee Fund, Ministry of Finance, Polish Chamber of Insurance, Financial Ombudsman, Office of Competition and Consumer Protection, Warsaw Institute of Banking, GPW Foundation, Centre for the Development of Education, Polish Chamber of Pension Funds, and CFA Society Poland.

Under the GMW2023 programme, the UKNF carried out a cycle of 13 webinars for students and teachers as part of the Education Centre for Market Participants (CEDUR) project. The webinars addressed topics such as, for example, how to protect oneself from cybercriminals and not get robbed on the Internet, what we should know about insurance and what to consider when choosing one, planning and managing personal finance, how to make reasonable investment decisions. More than 16.000 participants benefited from the training offer prepared by the UKNF.

GMW participants could explore the Campaign’s programme on a dedicated website prepared by the UKNF, with information on educational initiatives, projects, programmes, tools and materials, such as lesson scenarios, comics, animations, podcasts. All the activities, educational materials and tools related to GMW2023 proposed by the institutions were free of charge and most of them accessible through digital means.

The Ministry of Finance developed educational tools which could be used by teachers and educators during the activities organised as part of the GMW, including participation in the Ministry’s educational programme Finansoaktywni, TAXEDU, as well as a virtual tour of the Ministry of Finance.

The Bank Guarantee Fund contributed to the CEDUR webinars by preparing a presentation on the rules of the deposit guarantee system in Poland. This was attended by over 500 participants.

During the CEDUR webinars, the Office of Competition and Consumer Protection presented an educational tool called konsument.edu.pl. The website is a simulator of a social networking site which initiates 10 incidents/threats actually occurring online, e.g. online purchase scam, BLIK code phishing, subscriber scam, alternative investments, pyramid schemes, fake charity collection. The webinar was attended by more than 900 participants, and during the GMW the website was visited by twice as many users as in the week preceding the Campaign.

During GMW2023, the Financial Ombudsman in cooperation with specialists prepared lesson scenarios covering topics such as safe financial transactions online, the system of protection of consumers’ rights in the financial market, how to write a complaint to a financial institution. The Financial Ombudsman also organised a webinar: ‘Interest is not all that matters. How much does a consumer credit actually cost?’ and an on-site educational meeting with students at secondary schools in Zamość. In total, nearly 450 participants took part in both events.

The Polish Chamber of Insurance (PIU) prepared online classes on insurance: how risk management affects the stability of household finances and how insurance helps to secure the home budget in case of unexpected events. The educational materials prepared by PIU included lesson scenarios improving financial competences and a presentation for the subject ‘Business and Management’. The PIU website containing educational materials was visited by more than 3.000 people. A few hundred people have listened to PIU podcasts on YouTube.

Within GMW2023, the Polish Chamber of Pension Funds (IGTE) and CFA Society Poland offered free access to an e-learning course on personal finances ‘Well-groomed finances’ (Zadbane finanse) for students above 18 years old. IGTE also offered the possibility to download the Pension guide (Przewodnik emerytalny). As a result of the initiative, 81 people signed up for the course and 70 people downloaded the publication.

As part of GMW2023, the 8th edition of Congress of Financial Education and Entrepreneurship took place on 23–24 March and was attended by more than 400 participants. The Congress was organised by the Warsaw Institute of Banking and the GPW Foundation. The three nation-wide online classes organised within the Congress were attended by more than 11.000 students and teachers from across Poland.

The Centre for the Development of Education provided on a page dedicated to the GMW access to educational materials, including lesson scenarios for students of primary and secondary schools. Quizzes on finance were also organised. The teachers running the 15th edition of the project ‘How to manage your finances in personal life’ conducted workshops for students at secondary schools.

On the occasion of the GMW, the Czepczynski Family Foundation conducted a workshop for children from a local school in Chrzypsko Wielkie, based on its education project ‘ABC of Economics, first steps in the world of finance’. Children could learn about money, its history, where it comes from, and about various methods of payment.

2022 Poland Global Money Week

GMW NATIONAL COORDINATOR:

- The Polish Financial Supervision Authority (UKNF)

PARTICIPATING ORGANISATIONS:

- Ministry of Finance (MF), National Bank of Poland (NBP), Bank Guarantee Fund (BFG), Office of Competition and Consumer Protection (UOKiK), Financial Ombudsman (RF), Polish Chamber of Insurance (PIU), Warsaw Stock Exchange Foundation (Fundacja GPW), Warsaw Institute of Banking (WIB), Society for Promotion of Financial Education (SKEF), Czepczyński Family Foundation (CFF), schools of different educational stages and other educational facilities

TOTAL NUMBER OF PARTICIPATING ORGANISATIONS:

- 204

NUMBER OF CHILDREN AND YOUNG PEOPLE REACHED DIRECTLY:

- 34,422

NUMBER OF ADULTS REACHED DIRECTLY:

- 3,500

NUMBER OF PEOPLE REACHED INDIRECTLY:

- Not reported

Over 34,000 students and teachers registered to participate in the 10th, jubilee edition of the Global Money Week campaign in Poland. It was held on 21–27 March under the slogan “Build your future, be smart about money.” GMW2022 programme covered financial education activities organised at schools at all stages of education. The GMW coordinators at schools implemented their own initiatives or took part in events organised by the national GMW coordinator – the UKNF – and partners.

As part of the campaign, the UKNF organised a cycle of 12 CEDUR webinars addressed to primary and secondary schools students and teachers. The series of training courses covered, among others, the basic aspects of electronic payment methods, banking activity and operations, guidelines for a better understanding of credit agreements for young adults, interest rate – what it is and how to make friends with it, whether inflation is good for our wallet, trading in financial instruments at the Warsaw Stock Exchange (WSE), the rules on prudent investing in the financial market, mobile phone safety – how to protect oneself from cybercriminals, and how to avoid online theft. Over 11,200 students and teachers took part in the training courses organised by the UKNF.

The agenda of GMW2022 was enriched by financial education initiatives and educational materials of other institutions that were involved in the campaign, i.e. the Ministry of Finance, the Bank Guarantee Fund, the Office of Competition and Consumer Protection, the Financial Ombudsman, the Polish Chamber of Insurance, the Warsaw Institute of Banking, the Warsaw Stock Exchange Foundation, the Centre for the Development of Education, and the Czepczyński Family Foundation. Over 9,000 people participated in events organised by institutions cooperating with the UKNF.

The participants of the GMW campaign could find the campaign’s programme at a dedicated website prepared by the UKNF. It included information on projects, financial education initiatives, available tools and educational materials, such as lesson scenarios, comics and animations.

The Ministry of Finance developed educational tools that educators could use during their activities. These resources covered different scenarios for lessons on taxes and the state budget. Participants could also take part in the “MF Academy” project, the online educational platform TAXEDU that hosts educational animations and a virtual tour of the Ministry.

The Bank Guarantee Fund contributed to the CEDUR webinars by preparing a presentation on the rules of the deposit guarantee system in Poland. It was attended by almost 480 participants.

Representatives of the Office of Competition and Consumer Protection prepared a webinar presenting a modern and free educational tool, an online fraud simulator, published at konsument.edu.pl – a website resembling a social networking site where booby-trapped offers pop up among regular posts. This tool teaches users about online safety rules. The webinar was attended by over 1,300 participants and the website was visited by 230 users during the GMW campaign.

As part of the campaign, the Financial Ombudsman, in cooperation with experts, prepared lesson plans that present key topics related to financial education and financial market. All these materials were made available for download on the Financial Ombudsman’s official website. The Financial Ombudsman also organised a webinar on the security of online payments that was attended by almost 500 students and 72 adult participants. The session was primarily addressed to teachers and secondary school students. It helped to answer the question how to stay safe when paying online. During the discussions, the participants had a chance to learn how to protect their personal data and finances against fraud, what situations to avoid and what to do when they fall victim to fraud.

As part of the GMW, experts from the Polish Chamber of Insurance conducted three online lessons for secondary school students, showing that insurance is an essential part of a household budget and an effective tool for managing fears. The lessons were attended by ca. 700 students. The youth could also learn through comics that illustrated insurance concepts in a nutshell.

The Global Money Week also included the 6th edition of the Congress for Financial Education and Entrepreneurship held on 23 and 24 March under the slogan “Financial education – a mutual duty for present and future generations” by the Warsaw Stock Exchange Foundation (Fundacja GPW) and the Warsaw Institute of Banking (WIB). The event was attended by 3,259 individuals from across Poland via a dedicated platform and through online transmission of selected parts of the agenda.

The Society for Promotion of Financial Education launched a dedicated tab on its website, which was visited by 830 people. Over 324 people tested their knowledge through a financial quiz, and more than 512 students participated in classes and personal finance management sessions.

The Czepczyński Family Foundation (CFF) organised a number of online events. A virtual training session was addressed to teachers, educators, parents and guardians interested in financial education. They also shared suggestions on how to talk to children about economics and finances. It was attended by more than 900 participants. The CFF conducted two online lessons for children of 5 to 10 years old. The first lesson was devoted to the household budget. Children could find out what constitutes income and expenses in the household budget and what are needs and wants. This lesson was conducted in Polish and gathered more than 1,000 participants. Another lesson was about price. This lesson was based on the book “ABC of Economics. First steps in the world of finance” as well as worksheets and infographics and was conducted in English. It was followed by more than 800 participants. The Czepczyński Family Foundation also organised an online debate with young entrepreneurs. This event was attended by more than 1,400 participants. Recordings from all the meetings can be found on the CFF website.

All the activities, educational tools and materials related to GMW2022 proposed by the institutions were free of charge and accessible through digital means.

During Global Money Week 2022, the National Bank of Poland (NBP – Narodowy Bank Polski) reached thousands of Poles by organising many interesting educational events for various groups of people – from the youngest preschoolers and students in primary and secondary schools to senior citizens. NBP employees conducted online lessons and meetings, quizzes and competitions for over 2,500 students all over Poland. In local radio stations, they discussed the role of the central bank, its tasks and functions in the state economy, expenditure planning and financial security in the era of COVID-19, war reality, and more. The NBP encouraged everyone to use educational materials available here and here. On this website all users could choose educational materials on money and financial stability, lesson scripts, simple animations introducing difficult economic concepts, but also lectures conducted by the NBP experts. The National Bank of Poland focused on improving young people’s financial skills and knowledge of wise money management by reaching various audiences across the country with information about the campaign.

2021 Poland Global Money Week

GMW NATIONAL COORDINATOR:

- The Polish Financial Supervision Authority (UKNF)

PARTICIPATING ORGANISATIONS:

- Ministry of Finance (MF), Office of Competition and Consumer Protection (UOKiK), Polish Chamber of Insurance (PIU), Bank Guarantee Fund (BGF), Society for Promotion of Financial Education (SKEF), National Bank of Poland (NBP), schools of different educational stages and other educational facilities, universities, public library, day support centres, local non-profit organisations, provincial police headquarters, municipalities and local radio stations

TOTAL NUMBER OF PARTICIPATING ORGANISATIONS:

- 295

NUMBER OF CHILDREN AND YOUNG PEOPLE REACHED DIRECTLY:

- 23,070

NUMBER OF ADULTS REACHED DIRECTLY:

- 1,782

NUMBER OF PEOPLE REACHED INDIRECTLY:

- 100,000

Throughout Global Money Week 2021, the Polish Financial Supervision Authority (UKNF) along with partners reached over 18.5 thousand children and young people from at least 160 schools of each educational stage across Poland, in many cases located in small towns and villages.

Thanks to cooperation between institutions involved in financial education, GMW2021 in Poland was not only the most successful one in terms of reach of the campaign but also in terms of variety of issues related to finance that were raised during the Week and variety of activities offered to participants despite the challenges of online learning.

The UKNF created a sub-page dedicated to the GMW here to provide information and practical advice for participants but also to enable dissemination of financial education projects, programmes, initiatives and materials, both existing and new ones.

The schools showed great interest in the series of nine financial education webinars organised by the UKNF during the Week within an educational project called CEDUR – The Education Centre for Market Participants – available here. The webinars covered topics such as the functioning of the financial market, for example banking activity and operations, financial products and services, guidelines for a better understanding of credit agreements for young adults, investing through investment funds, cyberthreats and cybersecurity from the perspective of financial service users. The webinars reached over 4.5 thousand children, young people and teachers from over 120 schools.

The Bank Guarantee Fund contributed to the webinars by preparing a presentation on the rules of the deposit guarantee system in Poland. It was attended by almost 350 participants.

The Ministry of Finance offered free teaching materials within the “Finansoaktywni” programme available here, – an educational programme to help teachers teach students about taxes (i.e. types of taxes, why we pay them, and what is funded by taxation) and budget (national, local and personal). During the GMW, 41 schools with approximately 2,334 students used these materials.

The Polish Chamber of Insurance held two webinars – a lesson on insurance for secondary school students attended live by over 500 participants and a training course for teachers. The webinars focused on the most important elements of insurance and its role in managing risks that may affect the stability of household finances. The comic books about insurance (available here) prepared for the youngest attracted great interest and reached several thousand people.

The Society for Promotion of Financial Education launched a dedicated tab on the website here, which was visited by 2,365 people. Over 700 primary and secondary school pupils took the financial knowledge quiz, and over 530 secondary school students participated in classes on personal finance management.

The Office of Competition and Consumer Protection provided access to the website konsument.edu.pl (available here), a virtual simulator of online threats lurking and waiting especially for young consumers. The site resembles a social networking site where booby-trapped offers pop up among regular posts.

All the activities, educational tools and materials related to GMW2021 proposed by the institutions were free of charge and accessible through digital means.

Besides a wide range of initiatives offered by the institutions, children and youth could benefit from other activities organised locally at their schools throughout the Week. The younger students created money boxes from recyclable materials and catchy slogans on saving money. The youth participated in financial educational quizzes, created their own personal budgets, took part in saving surveys, ran their own projects such as rankings of bank accounts for teens and young adults, and made a GMW school blog.

During the Global Money Week, the National Bank of Poland reached hundreds of thousands of people by organising a number of interesting educational events for various age groups – from the youngest preschoolers and students from primary and secondary schools to university students, parents and senior citizens.

The NBP employees conducted digital lessons and meetings, quizzes and competitions for over 4,000 students all over Poland, and organised online lectures for 300 students. In local radio stations, they educated everyone about how to safely manage personal finances and introduced Global Money Week to everyone. The official theme of GMW2021 “Take care of yourself, take care of your money” was promoted as a topic for events and activities. A specific subpage at nbp.pl/edukacja (available here), was created to share information on the campaign. Numerous people who visited the subpage could choose from studies on personal finance, lesson scripts, simple animations introducing difficult economic concepts, and lectures conducted by experts from the NBP on “How much does a loan cost?”, “Mysterious APRC (Annual Percentage Rate of Charge)”, “The Sharing Economy”, and a lot more.

Despite the challenging COVID-19 time and the need to organise activities primarily in the virtual space, various audience groups across the country were reached. Many people were informed about the campaign, wise money management techniques, and the importance of increasing financial skills of young people.

2019 Poland Global Money Week

LEADING ORGANISATIONS:

- The Polish Financial Supervision Authority (UKNF) in cooperation with the Ministry of Finance

PARTICIPATING ORGANISATIONS:

- Biblioteka Publiczna im. Władysława Jana Grabskiego w Dzielnicy Ursus m. st. Warszawy, Branżowa Szkoła I Stopnia Rzemiosła i Przedsiębiorczości w Bydgoszczy, Centrum Kształcenia Ustawicznego w Wyszkowie, CLVI Liceum Ogólnokształcące Integracyjne Przy Łazienkach Królewskich w Warszawie, Gminny Zespół Szkolno-Przedszkolny nr 3 w Rębielicach Królewskich, I Liceum Ogólnokształcące im. Oskara Kolberga w Kościanie, II Liceum Ogólnokształcące im. S. Wyspiańskiego w Będzinie, Liceum Ogólnokształcące COR w Bielsku-Białej, Liceum Ogólnokształcące im. ks. Piotra Skargi w Sędziszowie Małopolskim, Liceum Ogólnokształcące nr VIII im. Bolesława Krzywoustego, Ośrodek Rehabilitacyjno-Edukacyjno-Wychowawczy w Olsztynie, Powiatowe Centrum Kształcenia Zawodowego i Ustawicznego w Wieliczce, Publiczna Szkoła Podstawowa im. Wojciecha Bogumiła Jastrzębowskiego w Nowej Osuchowej, Publiczna Szkoła Podstawowa nr 15 im. Władysława Syrokomli w Radomiu, Publiczna Szkoła Podstawowa nr 2 im. Jana Pawła II w Szydłowcu, Publiczna Szkoła Podstawowa nr 5 w Stalowej Woli, Publiczna Szkoła Podstawowa w Michałowie, Publiczna Szkoła Podstawowa w Świętej Katarzynie im. Kardynała Stefana Wyszyńskiego Prymasa Tysiąclecia, Specjalny Ośrodek Szkolno-Wychowawczy nr 6 w Krakowie, Specjalny Ośrodek Szkolno-Wychowawczy w Firleju, Szkoła Podstawowa im. Aleksandra Kamińskiego w Guzowie, Szkoła Podstawowa im. Astrid Lindgren w Dąbrowie, Szkoła Podstawowa im. Bohaterów Bukowskich w Buku, Szkoła Podstawowa im. Bronisława Tokaja w Nieporęcie, Szkoła Podstawowa im. gen. F. Kamińskiego w Maciejowie Starym, Szkoła Podstawowa im. gen. Tadeusza Kościuszki w Zieleniu, Szkoła Podstawowa im. Jana Brzechwy w Cyganach, Szkoła Podstawowa im. Jana Czesława Tajcherta w Czuryłach, Szkoła Podstawowa im. Janusza Korczaka w Michowicach, Szkoła Podstawowa im. K. Makuszyńskiego w Wiechlicach, Szkoła Podstawowa im. ks. Stanisława Augustyńczyka w Korzybiu, Szkoła Podstawowa im. Łuku Mużakowa w Nowych Czaplach, Szkoła Podstawowa im. Orła Białego w Trzebielu, Szkoła Podstawowa im. Stanisława Ligonia w Truskolasach, Szkoła Podstawowa im. Stanisława Marusarza w Wojciechowie, Szkoła Podstawowa im. Wandy Kawy i Bronisławy Kawy w Kośmidrach, Szkoła Podstawowa im. Żołnierzy AK Cichociemnych w Brzozowie Starym, Szkoła Podstawowa nr 1 im. bł. Edmunda Bojanowskiego w Luboniu, Szkoła Podstawowa nr 1 im. Janusza Kusocińskiego w Złocieńcu, Szkoła Podstawowa nr 1 im. Tadeusza Kościuszki w Białobrzegach, Szkoła Podstawowa nr 1 im. Zofii Urbanowskiej w Koninie, Szkoła Podstawowa nr 13 im. Komisji Edukacji Narodowej w Olsztynie, Szkoła Podstawowa nr 2 im. Ks. Bronisława Markiewicza w Harcie, Szkoła Podstawowa nr 20 z Oddziałami Integracyjnymi w Siemianowicach Śląskich, Szkoła Podstawowa nr 246 im. 1 Dywizji Piechoty im. Tadeusza Kościuszki w Warszawie, Szkoła Podstawowa nr 32 im. Jerzego Dudy-Gracza w Częstochowie, Szkoła Podstawowa nr 74 w Krakowie, Szkoła Podstawowa nr 98 im. Piastów Wrocławskich we Wrocławiu, Szkoła Podstawowa Specjalna nr 168 w Łodzi, Szkoła Podstawowa w Biesalu, Szkoła Podstawowa w Kamionce, Szkoła Podstawowa w Ulanicy, Technikum nr 2 w Chojnicach, VII Liceum Ogólnokształcące im. Krzysztofa Kamila Baczyńskiego w Radomiu, Zespół Szkół Ponadgimnazjalnych im. I. W. Zakrzewskiego w Żelechowie, Zespół Szkolno-Przedszkolny w Kacwinie, Zespół Szkolno-Przedszkolny w Orzyszu, Zespół Szkół Ekonomicznych i Technicznych im. Stanisława Staszica w Słupsku, Zespół Szkół Ekonomicznych im. Jana Amosa Komeńskiego w Lesznie, Zespół Szkół Ekonomicznych im. ks. Janusza St. Pasierba w Tczewie, Zespół Szkół Ekonomicznych im. M. Kopernika w Kielcach, Zespół Szkół Ekonomicznych w Mińsku Mazowieckim, Zespół Szkół Ekonomicznych w Radomiu, Zespół Szkół Elektryczno-Elektronicznych w Radomsku, Zespół Szkół Gospodarczych w Elblągu, Zespół Szkół im. bł. ks. Piotra Dańkowskiego w Jordanowie, Zespół Szkół im. T. Kościuszki w Łobzie, Zespół Szkół Mechanicznych nr 3 w Krakowie im. gen. Władysława Sikorskiego, Zespół Szkół nr 1 im. Bohaterów Westerplatte w Garwolinie, Zespół Szkół nr 1 w Opatowie, Zespół Szkół nr 2 im. T. Kościuszki w Garwolinie, Zespół Szkół nr 36 im. M. Kasprzaka w Warszawie, Zespół Szkół nr 4 im. Obrońców Mławy z Września 1939 r. w Mławie, Zespół Szkół nr 4 im. Ziemi Podlaskiej w Bielsku Podlaskim, Zespół Szkół Ogólnokształcących nr 2 w Kwidzynie, Zespół Szkół Ogólnokształcących nr 5 w Bydgoszczy, Zespół Szkół Ogrodniczych i Ogólnokształcących im. Mariana Raciborskiego w Pruszczu Gdańskim, Zespół Szkół Ponadgimnazjalnych nr 1 im. ks. St. Konarskiego w Jędrzejowie, Zespół Szkół Ponadgimnazjalnych nr 2 w Rudzie Śląskiej, Zespół Szkół Ponadgimnazjalnych w Białogardzie, Zespół Szkół Społecznych STO w Łodzi, Zespół Szkół Spożywczo-Gastronomicznych w Warszawie, Zespół Szkół Techniczno-Ekonomicznych w Skawinie, Zespół Szkół Technicznych im. gen. prof. S. Kaliskiego w Turku, Zespół Szkół w Krzywdzie, Zespół Szkół w Mszczonowie, Zespół Szkół w Rzepinie, Zespół Szkół Zawodowych im. Piastów Opolskich w Krapkowicach, Zespół Szkół Zawodowych Nr 4 im. Adama Chętnika w Ostrołęce, Zespół Szkół Zawodowych w Ozorkowie

NUMBER OF CHILDREN REACHED DIRECTLY:

- 11 785

NUMBER OF PEOPLE REACHED INDIRECTLY:

- 13 328

The Polish Financial Supervision Authority (UKNF)

To celebrate GMW2019, The Polish Financial Supervision Authority (UKNF), in partnership with the Ministry of Finance, ensured that many schools across the country participated in the global Campaign. The activities raised awareness about money matters amongst children and youth and allowed them to develop knowledge and skills needed to become financially independent and employable in the future.

The younger students created money boxes from recyclable materials and made posters on the GMW 2019 theme “Learn.Save.Earn.” The older students participated in art competitions. Additionally, the youth participated in financial educational games, created their own personal budgets, prepared classroom newspapers, broadcasted programs, and made a GMW school blog. The Ministry of Finance offered free teaching materials within the “Finansoaktywni” educational programme, which taught children how taxes work, why we pay them, and what is funded by taxation.

The GMW school coordinators were offered access to the UKNF’s publications on financial literacy. All teachers who took on the role of GMW school coordinator were invited to a training seminar on issues related to the financial market, organised by the UKNF within the educational project called CEDUR - The Educational Centre For Market Participants.

2018 Poland Global Money Week

LEADING ORGANISATIONS:

- KNF - Polish Financial Supervision Authority in cooperation with the Ministry of Finance

PARTICIPATING ORGANISATIONS:

- 86 schools of different types and stages of education (including preschools)

- 1 public library

NUMBER OF CHILDREN REACHED DIRECTLY:

- 10 500

NUMBER OF PEOPLE REACHED INDIRECTLY:

- 12 500

Polish Financial Supervision Authority (KNF)

During GMW2018, KNF involved schools from all levels of education in cities , small towns and villages in Poland.

Throughout the Week, almost 10,500 children and youth actively took part in a wide range of activities tailored to the participants’ age. All forms of activities gave children and youth the opportunity to understand why “Money Matters Matter” and to help develop their financial knowledge and skills, to make them financially independent and employable in the future.

The youngest children created money boxes from recyclable materials and posters on the GMW2018 theme “Money Matters Matter.” Older students entered a financial literacy skill and art. competitions, after which awarded posters, collages and infographics were displayed in the exhibitions.

Moreover, youth engaged themselves in GMW action by preparing multimedia presentations to use during workshops, lectures, and lessons. Additionally, they participated in activities such as short-movie making, carrying out personal budget surveys, preparing classroom newspapers, broadcast programs, and making a school blog on GMW.

Thanks to the cooperation of the Ministry of Finance, all participants benefited from free teaching materials. Furthermore, young entrepreneurs were able to enter in a competition, offered by the educational programme “Finansoaktywni”, which is aimed at helping children understand how taxes work, why we pay them, and what is funded by taxation.

KNF provided school coordinators with access to KNF publications, which included financial literacy class scenarios. Finally, they received GMW diplomas, KNF educational booklets, and small gifts for youth participants and competition winners.

2017 Poland Global Money Week

LEADING ORGANISATIONS:

PARTICIPATING ORGANISATIONS:

- 87 schools from each education stage, 1 public library

NUMBER OF CHILDREN REACHED DIRECTLY:

- 14 915

The Polish Financial Supervision Authority (KNF) involved 87 schools from each education stage throughout Poland in the Global Money Week 2017 celebration, reaching almost 15,000 children and youth. The 2017 campaign spread over quite large group of the pre-school pupils as well. The schools carried out a number of interesting activities and used various information channels including classroom newspapers, school radio broadcasting systems and social media to promote the Global Money Week message amongst not only the school environment but the local communities as well. There was also one public library among the participants.

The Polish Financial Supervision Authority further supported the schools’ coordinators by providing them with KNF’s publications, including financial literacy class scenarios referring to the theme “Learn. Save. Earn” theme, and KNF’s logo-imprinted small gifts in the form of school equipment for young participants and the winners of the competitions as well.

2016 Poland Global Money Week

LEADING ORGANISATIONS:

DATE OF THE EVENT:

- 14th - 18th of March

TOTAL NUMBER OF CHILDREN AND YOUTH ENGAGED:

- 2 006

The Polish Financial Supervision Authority (KNF) coordinated 50 different events and activities that took place in 13 primary and secondary schools all over the country during GMW 2016. Thanks to cooperation with active teachers and methodologists of economics, entrepreneurship and social studies who participated in KNF’s seminars and workshops, this year’s campaign reached more than 2000 pupils. The Polish Financial Supervision Authority supported the schools’ coordinators by providing KNF’s publications, including financial literacy class scenarios referring to GMW 2016's theme “Take Part. Save Smart”, and KNF’s logo-imprinted promotional gifts for youth participants and the winners of the competitions as well.

2014 Poland Global Money Week

PARTICIPANTS:

- Polish Financial Supervision Authority (KNF)

- Primary School number 46 in Warsaw, Poland

DATE OF THE EVENT:

- 12th of March

NUMBER OF CHILDREN REACHED:

- 38

The Polish Financial Supervision Authority (KNF) joined in on the Global Money Week action by organising an event to promote a new booklet made for children "Let's talk about finance. The handy ABC for Janek and Hania" ("Porozmawiajmy o finansach. Poręczne ABC dla Janka i Hani"). The booklet is distributed under the KNF’s financial services client guide cycle.

The authors of the booklet Dorota Bęben and Piotr Nowak prepared a short presentation which explained the benefits and tips on keeping a household budget. After the presentation, children took an active part in a workshop concerning family budget planning where they discovered how simple the methods of saving money are. At the end of the event each child received a booklet and a toy replica of a payment card.